Money Cannot Be "Fiat"

Why real money must be scarce and earned, not declared into existence. Without scarcity, money stops measuring value and becomes a tool of theft.

The word “fiat” comes from Latin, meaning “let it be done.” Fiat money is money by decree, created out of nothing simply because a government declares it so. But money is not supposed to exist by command. Its role is deeper: a neutral measure of value and a tool for coordinating human activity.

Money works as a unit of account, a common language of value. For it to serve this purpose, it must be something that cannot be manipulated. A measuring stick that changes length at will gives false information and destroys trust. True money must be rooted in scarcity, finite and limited in supply, so that every unit reflects real effort and exchange rather than arbitrary creation.

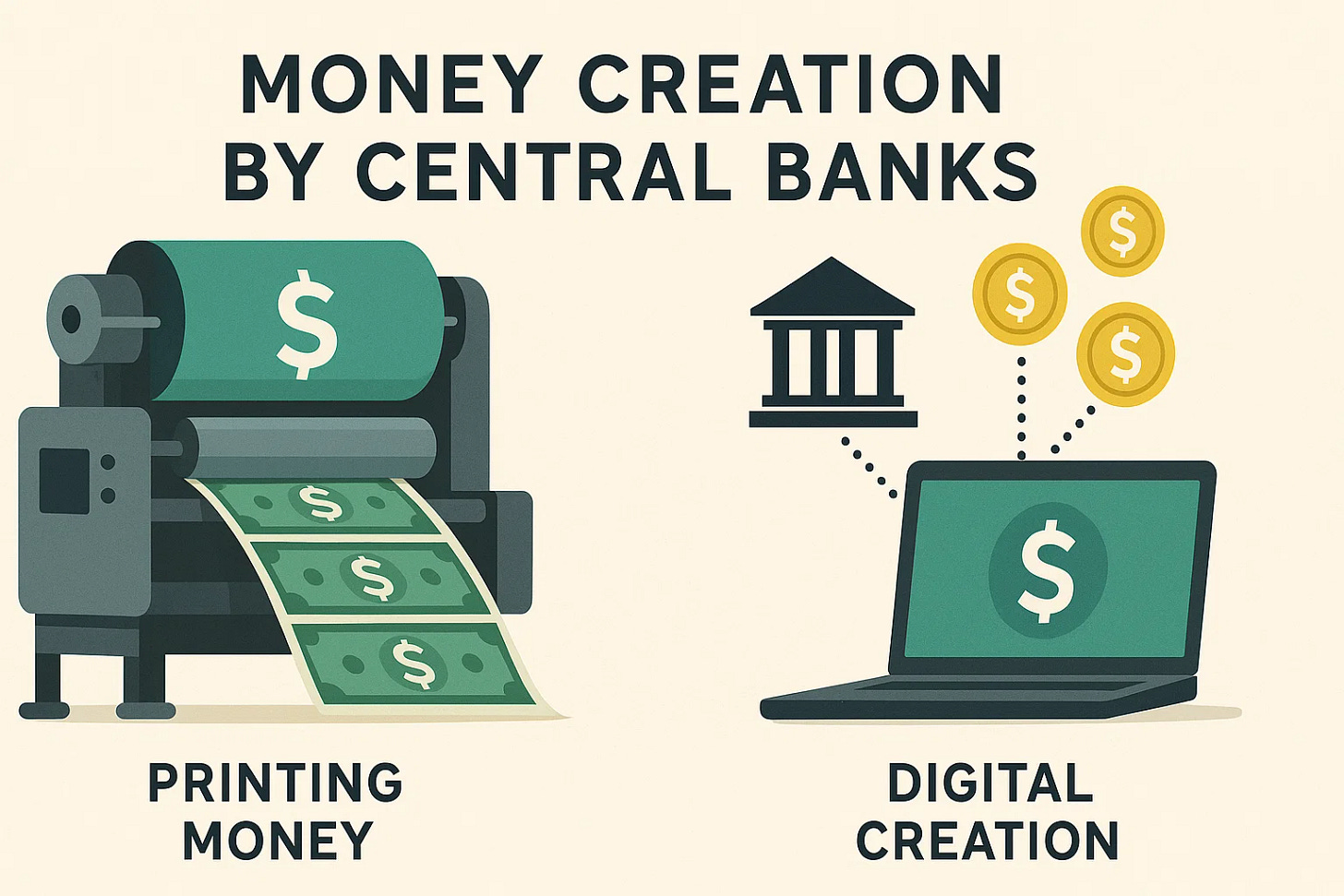

Throughout history, societies tried to anchor money in scarce goods like gold or silver. The reason was simple: scarcity makes money a reliable reference. Scarcity also ensures fairness across time, so that the work of one generation is not diluted by the decisions of the next. Fiat broke that principle. Today, central banks can create unlimited units with a keystroke. This is not money but a theft tool disguised as money.

In the past, fiat expansion was limited by printing presses or metal debasement. Now it is digital, faster and more extreme than ever. The abuse shows up in rising prices, distorted markets and constant debt. Inflation is not a natural law, it is the predictable result of fiat money.

Money cannot be fiat. It cannot be created by command or decree. It must be scarce, earned and incorruptible to fulfill its role as a measure of value and a foundation of cooperation. We need a scarce measure of value to measure the abundance of the human economy. Bitcoin restores this truth by fixing the supply at 21 million forever.

If this helped you see why money cannot be fiat, subscribe for more clear explainers and share this with one person who still thinks inflation is natural.

Read next: